Simple, smart accounting software that gives you complete control of your finances.

At home, in the office or on the go.

Your business wherever you are.

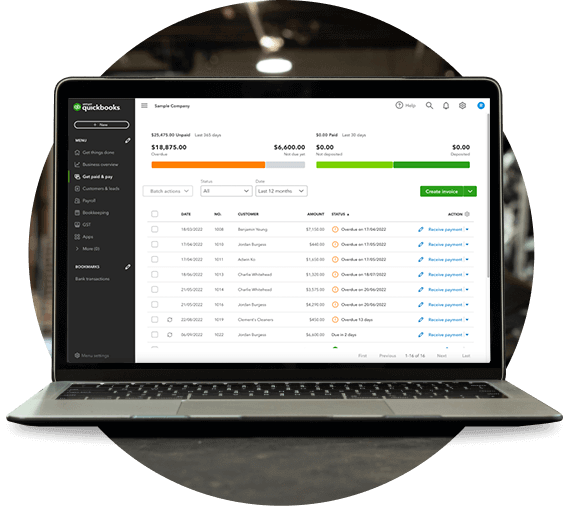

Get paid faster with effortless invoicing

Create and send professional invoices in seconds. See who’s paid and who hasn’t, and follow up with an automatic reminder.

Snap and store receipts

We pull the details right from your receipts, match them to a transaction and categorise it—so you're always ready for tax time.

Never touch a logbook again

Auto track your kilometres and categorise as business or personal. Every 1,000 KMs = $780 in tax deductions*.

92% of sole-trader customers agree that QuickBooks automates their accounting and bookkeeping.*

*Based on a survey conducted by Intuit Australia Pty Ltd in September 2022. Of the 90 respondents to this question who identified themselves as sole traders, 83 agreed or strongly agreed with this statement.

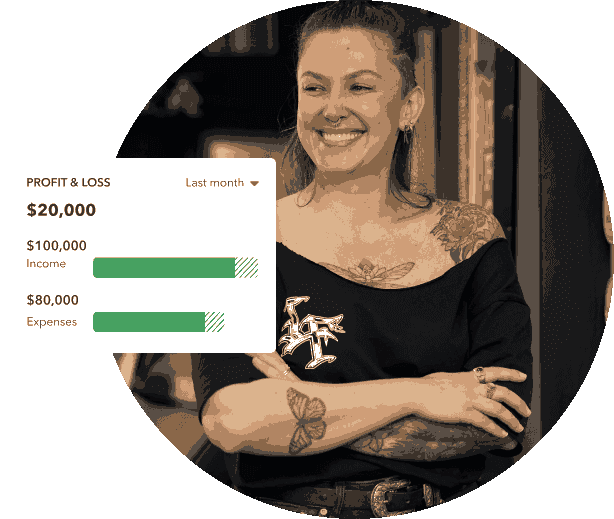

Track all income and expenses

Connect your bank accounts, credit cards, PayPal, and more to pull in all income and expenses automatically.

Accounting software for self-employed sole traders on the go

Learn how to use QuickBooks for self-employed sole traders with our free self-employed video tutorials.

Start today with no obligations

Benefits of accounting software for sole traders, freelancers and contractors

Learn why QuickBooks is the best accounting software for sole-traders.

Access your business data all in one place, anytime, anywhere

Access your QuickBooks account at any time, and run your self-employed business on any device. With cloud-based accounting software, you no longer need to be at your office desk or computer to access your financial information. QuickBooks accounting software for sole traders makes it easier for self-employed business owners like you to do accounting wherever you are. Access your data on the go from your laptop, smartphone or tablet.

Your data is stored securely in the cloud

QuickBooks accounting software for sole traders uses advanced, industry-recognised security safeguards such password-protected login, multi-factor authentication, firewall-protected servers and encryption technology to keep all your financial data stored securely in the cloud. Organise your finances in one secure, automatically backed up place and work anytime from any device.

Gain business insights to make smarter decisions

An accounting software solution is a self-employed business owner’s most important tool for decision-making. Get any-time access to balance sheets, cash flow statements, profit and loss statements, tax and GST information, and other customisable financial reports. Manage important financial data at your fingertips.

Ensures compliance at tax time

As a sole trader, freelancer or contractor it can be difficult to stay on top of receipts and get ready for tax filing. QuickBooks helps sole traders stay organised and prepared for tax time. Track your GST, and snap and save receipts from our mobile app to maximise deductions and stay compliant.

Give your accountant access to your books

Invite your accountant to access your books for seamless collaboration. Your data is protected with user-access levels which you can change and remove at any time.

Say goodbye to manual data entry with smart automation

QuickBooks takes the manual labour out of bookkeeping with automated features so busy sole traders and freelancers like you can get back to doing what you love most. There is no need for you to manually enter your data. Manual calculations, accounting rules and formulas are all taken care of for you and financial reports are available at the click of a button so you can focus on running your business.

No Installation Needed

QuickBooks is based in the cloud, simply sign-in and get started from any web browser. Unlike traditional accounting software that needs to be installed on individual desktops, QuickBooks accounting software does not require installation and can even be accessed on the go from your mobile device.

Access to expert customer support

Our team of experts are here to support you. We're rated #1 for customer support for Canstar's small business accounting software category. Get real time help via live chat where you’ll get an instant reply from our sales team. You can also join your QuickBooks Community, an online hub for QuickBooks answers and connecting with other QuickBooks users all over the world.

Seamlessly integrates with apps you use to run your business

QuickBooks seamlessly integrates with over 500 apps you already use to run your self-employed business. Connect to eCommerce, payment and inventory management apps to streamline the way you do business.

Access your business data all in one place, anytime, anywhere

Access your QuickBooks account at any time, and run your self-employed business on any device. With cloud-based accounting software, you no longer need to be at your office desk or computer to access your financial information. QuickBooks accounting software for sole traders makes it easier for self-employed business owners like you to do accounting wherever you are. Access your data on the go from your laptop, smartphone or tablet.

Your data is stored securely in the cloud

QuickBooks accounting software for sole traders uses advanced, industry-recognised security safeguards such password-protected login, multi-factor authentication, firewall-protected servers and encryption technology to keep all your financial data stored securely in the cloud. Organise your finances in one secure, automatically backed up place and work anytime from any device.

Gain business insights to make smarter decisions

An accounting software solution is a self-employed business owner’s most important tool for decision-making. Get any-time access to balance sheets, cash flow statements, profit and loss statements, tax and GST information, and other customisable financial reports. Manage important financial data at your fingertips.

Ensures compliance at tax time

As a sole trader, freelancer or contractor it can be difficult to stay on top of receipts and get ready for tax filing. QuickBooks helps sole traders stay organised and prepared for tax time. Track your GST, and snap and save receipts from our mobile app to maximise deductions and stay compliant.

Give your accountant access to your books

Invite your accountant to access your books for seamless collaboration. Your data is protected with user-access levels which you can change and remove at any time.

Say goodbye to manual data entry with smart automation

QuickBooks takes the manual labour out of bookkeeping with automated features so busy sole traders and freelancers like you can get back to doing what you love most. There is no need for you to manually enter your data. Manual calculations, accounting rules and formulas are all taken care of for you and financial reports are available at the click of a button so you can focus on running your business.

No Installation Needed

QuickBooks is based in the cloud, simply sign-in and get started from any web browser. Unlike traditional accounting software that needs to be installed on individual desktops, QuickBooks accounting software does not require installation and can even be accessed on the go from your mobile device.

Access to expert customer support

Our team of experts are here to support you. We're rated #1 for customer support for Canstar's small business accounting software category. Get real time help via live chat where you’ll get an instant reply from our sales team. You can also join your QuickBooks Community, an online hub for QuickBooks answers and connecting with other QuickBooks users all over the world.

Seamlessly integrates with apps you use to run your business

QuickBooks seamlessly integrates with over 500 apps you already use to run your self-employed business. Connect to eCommerce, payment and inventory management apps to streamline the way you do business.

The QuickBooks mobile app is free to download

Accounting software for sole traders in all industries

QuickBooks accounting software is used by sole traders, freelancers and contractors across different industries. Learn how QuickBooks features help self-employed business owners manage their bookkeeping and stay on top of their business finances.

Frequently asked questions

Customer success stories

Customer success stories