Wondering what the ideal business report format looks like? If so, look no further — you’ve come to the right place. We’re going to run through everything you need to know about the different types of reports, their purposes, and must-haves. Then, we’ll give you a step-by-step tutorial on how to create a professional business report in QuickBooks.

Choosing the ideal business report – QuickBooks Online

What is a business report?

Before looking at business report formats, you should know that there’s not one, single type of report — the contents (and the way they’re presented) will vary depending on your industry, your client, and the purpose of the report.

For example, if you’re a management consultancy, then you might conduct a thorough competitor analysis for one of your clients, including things like market share, key points of difference, and any recent competitor news.

On the other hand, if you’re an accounting firm, your business reports might be slightly different. They’ll likely include your clients’ ingoings and outgoings (credits and debits), as well as forward-thinking financial forecasts.

Regardless of the purpose, business reports are usually formal reports that present must-know information for either internal or external readers. A good business report is engaging and easy-to-understand.

On the other hand, poor business reports can be a nightmare to read, so it’s important that you get them right.

The essentials of a business report template

Report writing can seem like a tricky business — that’s why we’re here to help. Whatever the type of report, there are certain must-haves. Here are the four essential elements of your business report template.

1. A title page or cover page

Every business report should start with a title page. These should generally be formal and to the point, explaining what the report covers in simple terms (especially if it’s client-facing). That said, good design work will make a title page stand out — even if the title is a little dry.

2. A table of contents

This might seem obvious, but a table of contents including chapter headings is a key cornerstone of a good business report. The table of contents shows readers what the report covers and gives each chapter’s specific page number.

Without a table of contents, your readers might feel lost or confused when trying to briefly search for specific sections of the report.

3. An executive summary

The contents of your business report should start with an executive summary outlining all of the report’s main points in a couple hundred words.

A reader should ideally understand the main gist of your report just by reading the executive summary. You obviously won’t be able to include all relevant details, but this section should highlight the main points and conclusions that your report comes to.

4. The body

After the executive summary, it’s time to include the body of the report.

Remember that anything client-facing should be a formal business report — and should therefore be written in a business-like style. While you may have a great personal relationship with a client, your report should always display the utmost professionalism.

A formal business report avoids excessive colloquialisms, uses appropriate subheadings to break up the text, always cites when referring to outside sources, includes perfect grammar, and avoids unnecessary waffle.

However, there might be certain occasions when you can get away with creating informal reports — for example, if you’re creating a report for internal use only.

Some common types of business reports

Right, it’s all well and good knowing what a business report usually contains — but that doesn’t mean that they’re all the same. In fact, far from it. Let’s take a look at some of the more common types of business reports that you might encounter.

Business plans

Business plans outline your strategy for starting a business. You might show your business plan to the bank, angel investors, or even someone you want to bring on board in a leadership capacity.

They generally include things like market analysis, an explanation of your unique selling point (USP), and often a case study or two.

Research reports

Research reports usually delve into a specific issue — for instance, the Australian small business landscape in 2020.

They often start off by providing some background information for contextual purposes. In this case, that might be things like how to define a small business, the number of registered small businesses in Australia, and their importance to the economy at large.

As well as setting up the issue with contextual information, research reports also include a thorough methodology explaining the nature of their research, an in-depth analysis of the results, and some form of conclusion based on the major findings.

Financial reports

Financial reports are formal business reports, which are usually very data-heavy. It’s worth noting that whilst you probably use Excel for data collection purposes, spreadsheets are a no-no in reports. Instead, consider presenting the data in a more reader-friendly way by using infographics.

Project reports

Project reports relate to a specific project that your company has completed: the initial goals, the decision-making processes, the results, and perhaps any next steps. The focus is very narrow with project reports, so they’re usually shorter and more to the point than research reports.

Business analysis reports

If your company has an internal business intelligence team, then these are the sorts of reports that they’ll produce on a regular basis.

Business analysis reports will usually focus on one solving a particular problem or presenting an area of improvement: outlining suggested operational changes, demonstrating the results from any competitor analysis, and generally offering up potential solutions to the issue at hand.

What are some common business report templates?

Your business report template will vary according to your report’s specific needs — it goes without saying that an annual report looking at a client’s finances will be different from an internal quarterly update.

If you’re looking for some great ideas (and downloadable example templates), there’s plenty of inspiration out there to help get you started.

How to create a management report in QuickBooks

The QuickBooks Management Reports function allows you to create a set of beautiful client-facing reports in an easily downloadable PDF format — these include a cover page, executive summary, and notes.

If you’ve ever wanted to wow your clients with a professional-looking and highly customisable financial report, you’ve come to the right place.

4 steps to creating your very own management report

It’s now time to create your very own financial reports in QuickBooks. If you’re looking to wow your boss or your clients, then look no further.

Once you’ve logged into your QuickBooks account, follow these 4 steps to get started:

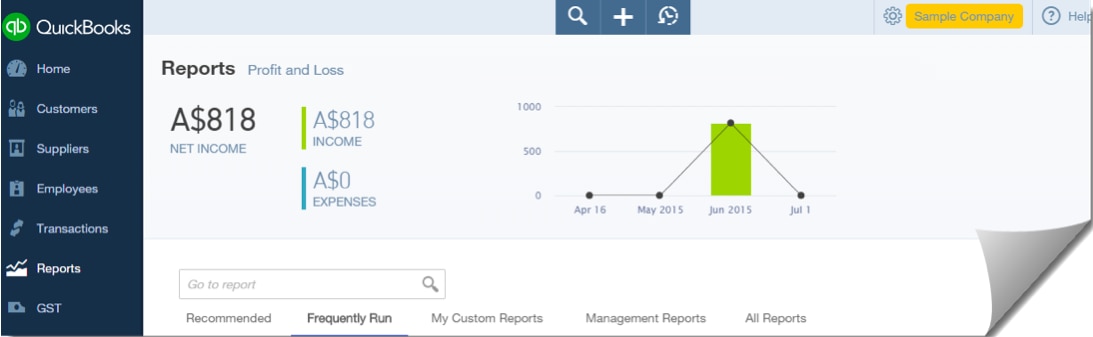

- Select Reports

- Select Management Reports

- Choose your report period

- Preview the chosen template

Right, so you’ve now picked a potential template — the first stage of creating your report is complete.

Customising the management report template

You might not be 100% sure about your template. Sure, it’s better than all the other options, but is it really what you’re looking for?

If this is what you’re thinking, there’s no need to worry. You can customise the template to your liking.

For instance, you can customise Management Reports to include:

- A cover page

- An executive summary and financial notes

- A variety of financial reports

- A header and footer

If you want to begin customising your report, click ‘Edit’ from the Management Reports window.

From the left-hand side navigation bar, you can then start to edit each different section of the report. In the image above, you’ll see:

- The cover page labeled with the number.

- The section labeled with the number 2 is where you can change the cover style and logo, specify a cover title, subtitle, and other fields.

- If you want to include a table of contents and change the page title then click on the ‘Table of contents’ option in the sidebar, labeled number 3.

- If you want to include preliminary pages, click on the number 4 section in the left-hand sidebar. Enter a unique title, add notes, and insert fields at places where you want predefined company content to appear.

- The section labeled 5 is where you can add or delete reports, change the title (this will affect the table of contents), change the reporting period, and add previous period or year comparison columns if applicable.

- Click on section number 6 if you want to include endnotes. You can include a breakdown of sub-accounts. Here, you can type out the content or paste from another location, such as Microsoft Word.

Once you’ve customised the report package and saved it as a new report, such as Sales Performance 123 (see above), you can choose to send it via email, export it as a PDF or as a DOCX, copy the package, or delete it if you’re unhappy with how it’s turned out.

Just remember to change the reporting period for your next management report in your saved template — that’s all that’s required.

If you’re new to Management Reports, try editing the pre-made templates within QuickBooks Online and edit with your requirements. Alternatively, check out our in-depth guide to creating reports if you have any other queries.

Management Reports will save you a considerable amount of time, as you’ll no longer need to assemble a full pack of customised reports and content outside of QuickBooks Online.

This feature allows you to pull the entire package together quickly and easily, with all the data you need to make the management report accurate, eye-catching, and impressive to your clients.

Summary

A well-created business report can impress, inform, and inspire both colleagues and clients alike. We hope you’ve found this guide useful, and that it’s given you some top tips on how to create your very own professional business report.

Now, it’s up to you — make your reports engaging and easy to read.

Related Articles

Looking for something else?

Stay up-to-date with the latest small business insights and trends!

Sign up for our quarterly newsletter and receive educational and interesting content straight to your inbox.

Want more? Visit our tools and templates!